Protect Your Family from Big Tech’s Influence

More Than 2 Million Parents Love Mobicip

Featured on

-

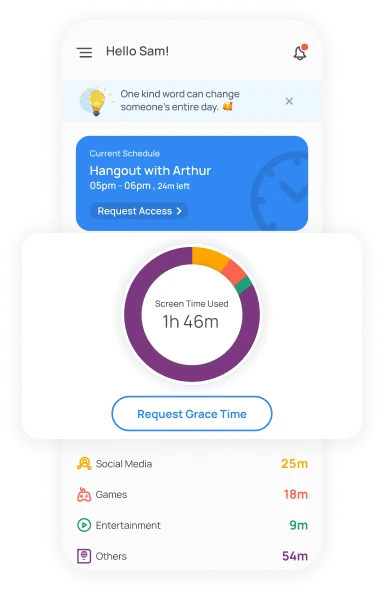

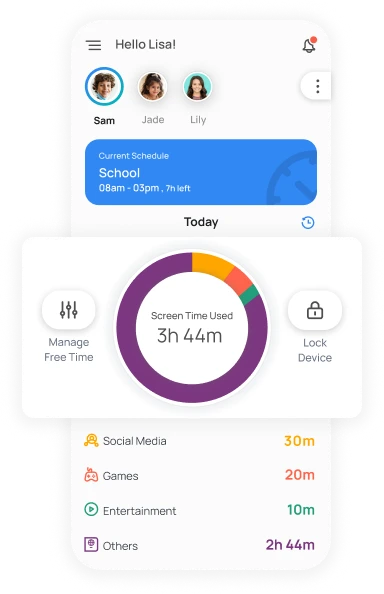

Limit

Effectively manage screen addiction with healthy limits

Set daily/weekly screen time limits, set app limits for using specific apps, and customize schedules to organize screen time and app usage at different times of the day/week.

-

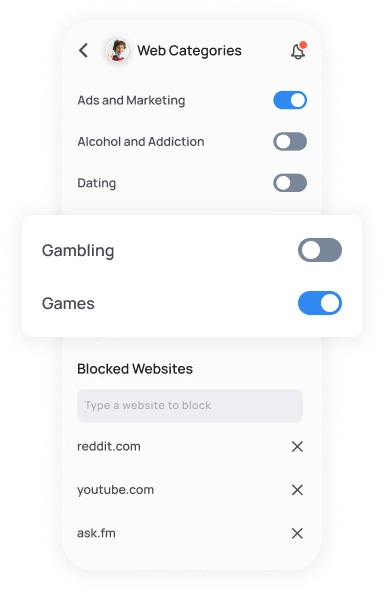

Protect

AI-based parental control that fights Big Tech

Filter inappropriate content on the internet, block apps, distracting games and provide an SOS button for your kids to instantly send a digital call for help in case of emergency.

-

Monitor

Monitor online habits & intervene when alerted

Monitor conversations on the top 3 social media apps, create geo-fences, locate your family instantly, and get reports on how your kids spend their time online.

-

Collaborate

Collaborate with your children and parenting partners

Set mutually acceptable goals & rewards to motivate your children, get a curated list of expert resources and share digital parenting responsibilities with guardians.